Funky Gazelle Chronicles

Exploring the quirky side of life through news and insights.

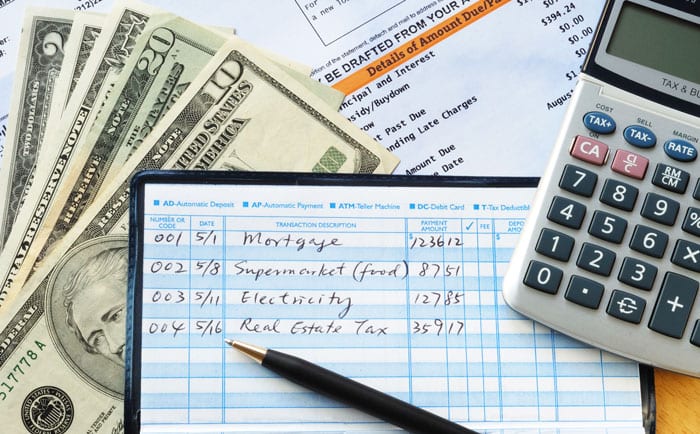

Budgeting Like a Pro: Become Your Own Financial Wizard

Master your finances and unlock the secrets to budgeting like a pro! Transform into your own financial wizard today!

Top 5 Budgeting Techniques Every Financial Wizard Uses

When it comes to mastering your finances, budgeting techniques can make all the difference. Here are the Top 5 Budgeting Techniques every financial wizard incorporates to maintain control over their expenses and savings:

- The 50/30/20 Rule: This popular budgeting method divides your income into three categories. Fifty percent goes to essentials, thirty percent to discretionary spending, and twenty percent to savings or debt repayment.

- The Envelope System: This technique involves allocating cash into envelopes designated for specific spending categories, encouraging you to stick to your budget.

- The Zero-Based Budget: Every dollar in your budget is assigned a purpose, including savings or debt payment, which means your income minus your expenses equals zero.

- The Pay-Yourself-First Strategy: Prioritize savings by treating it like a bill; set aside a fixed amount from your income before spending on other expenses.

- The Value-Based Budgeting: This method focuses on aligning your finances with your personal values, ensuring your spending reflects what truly matters to you.

Counter-Strike is a popular first-person shooter game that emphasizes team-based gameplay and strategy. Players can choose to play as terrorists or counter-terrorists, each with distinct objectives. For those looking to enhance their gaming experience, consider checking out the Top 10 iphone accessories under 100 to find great gear that complements your gaming setup.

How to Create a Budget That Works for You: A Step-by-Step Guide

Creating a budget that works for you requires a proactive approach and a clear understanding of your financial goals. Start by assessing your current financial situation, which includes tracking your income and expenses for a month. Identify your fixed costs, variable expenses, and discretionary spending. It’s essential to categorize these expenses so that you can pinpoint areas where you may need to cut back. Once you have a complete picture, you can begin to set realistic financial goals, thus paving the way for a budget that suits your lifestyle.

Next, take a step-by-step approach to drafting your budget. Follow these steps:

- Establish a total monthly income, including all sources, to know your financial baseline.

- List all your expenses, organizing them into fixed and variable categories.

- Allocate funds to each expense category based on your income and goals.

- Review and adjust your budget monthly, ensuring it reflects any changes in your circumstances.

Do You Know Your Spending Triggers? Identifying and Overcoming Them

Understanding your spending triggers is crucial for effective financial management. These triggers are emotional, psychological, or environmental factors that lead you to make unplanned purchases. Common spending triggers include stress, boredom, and social pressures. By identifying these factors, you can begin to regain control over your finances. Start by keeping a spending journal for a month, noting what you buy, when you buy it, and how you feel before the purchase. This awareness can help you pinpoint specific triggers.

Once you recognize your spending triggers, the next step is to develop strategies to overcome them. Here are a few effective methods:

- Pause Before You Buy: Implement a waiting period for non-essential purchases.

- Emotion Regulation: Find alternative ways to cope with stress such as exercise or hobbies.

- Set Clear Budget Goals: Establishing a budget can help you distinguish between needs and wants.

By actively working to address your triggers, you can foster healthier spending habits and contribute to your overall financial well-being.